Steps to Estate Planning

Setting up an expansive and secure estate plan can be difficult, time consuming and incredibly confusing. With such large values of property at stake, everyone wants to make sure their wishes are set in stone and that minimal money is lost in the process.

Setting up an expansive and secure estate plan can be difficult, time consuming and incredibly confusing. With such large values of property at stake, everyone wants to make sure their wishes are set in stone and that minimal money is lost in the process. Contrary to popular belief, a detailed estate plan is not about huge taxes and massive trust funds; many are as simple as a couple sheets of paper.

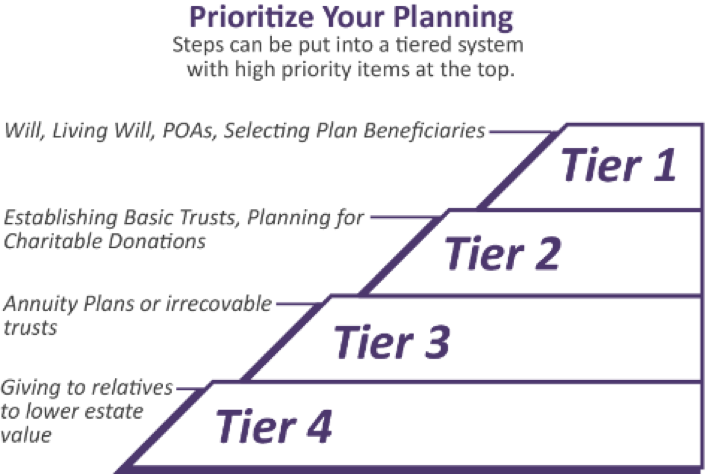

How much planning is enough? That depends on the goals you want to reach. Using a variety of methods, there is no limit to the amount of control you can put on your estate. And while not every estate requires every method of planning, it can be helpful to know the steps of planning available to you.

Benefits to Beneficiaries

The first and easiest step to planning an estate is establishing beneficiaries of private funds or policies, like life insurance policies, 401k plans and pensions.

This is the easiest step in estate planning because it is typically requested by most plans that a primary and secondary beneficiary be listed to receive funds in the event of a death. Though some plans, like life insurance, will require the beneficiary at signup, others may make it optional to do later. People often put off establishing beneficiaries, creating problems if they die suddenly. Whenever an option to name beneficiaries is offered, it should be handled immediately.

Wills

The next major step in estate planning is establishing a last will and testament. While a person who dies without a will (dying “intestate”) still has his or her property divided up among family, there are no guarantees over who gets what. A will is a simple way to make sure specific items get to the people who ought to have them.

If children are involved, a will becomes a necessity for a responsible parent. Wills determine who gets legal guardianship over the surviving children. Though a court will take this process seriously if the decision is left up to them, it is far better for the parents to designate the people they would like to raise their children. A will stating guardianship should be top priority for anyone with children.

Though useful for declaring who should receive property, wills do not automatically guarantee another person can receive it. If property is owned jointly with a right of survivorship or is kept as “community property” between a married couple, ownership may be transferred before a will goes into effect. Though most state’s marital property is not treated this way, individuals should be aware of their state’s marital property laws prior to creating a will.

Handing Over Power

Potentially as difficult as a death, the medical incapacitation of an individual can cause huge amounts of stress for a family. Living wills give instructions for the medical care of an individual given they are in an incapacitated, terminal condition. Though limited to these specific situations, living wills can spare a surviving family from difficult decisions and prevent conflict between members who have different views on treatment.

A more in-depth approach to prepare for sudden incapacitation is the creation of “power of attorney,” a document that gives a named individual the ability to act on behalf of the disabled in legal matters. Drafted for both medical and financial decision making, power of attorney documents can be extremely difficult to detail and should only be created by a legal professional.

Trusts

Though many people think trusts are financial bodies that are only meant for the wealthy, the truth is they can be used by most people to create detailed control over an estate. A trust is simply a legal entity that holds property for the benefit of a few named individuals.

Though the major advantages of a trust are deferring probate fees and having circumstantial control over property distribution, trusts are also useful for couples who have children from prior marriages. In a trust, a person can place property that would pay interest to help support the surviving spouse, but ultimately distributes property to his or her children, guaranteeing they receive some of the inheritance.

Gifting

Individuals looking to reduce their estate before death should consider simply giving money away to loved ones later on in life. Each year, a person can give up to $14,000 tax-free to each unique individual or institution they choose. As long as the gifts stay below this amount, they will remain tax-free and still not count against the lifetime gift tax exemption. There are no transfer taxes on gifts made to public charities, regardless of size.

Securing Estate Documents

After necessary estate documents are prepared, they should be adequately stored and protected. Wills are the most difficult to protect. Most states recognize only the original signed document as having any legal power. If the original is destroyed, a new will must be drafted. Typically, the law firm where the document was created will offer to keep the will in an extremely secure safe.

Other documents, such as living wills and power of attorney, can typically be copied and notarized to create duplicates that carry the same legal power as the original. As with wills, loved ones should be informed of the documents’ location so they can be accessed when needed.

Estate planning can be a difficult process for people. The concept of preparing property for an accident or death is hardly something people want to spend time considering. Though its creator will never see it used, a well-written, well-conceived estate plan can make all the difference for friends and family.

The information contained in this article is not intended to be tax, investment, or legal advice, and it may not be relied on for the purpose of avoiding any tax penalties. Fingerlakes Wealth Management does not provide tax or legal advice. You are encouraged to consult with your tax advisor or attorney regarding specific tax issues.This article was written by Advicent Solutions, an entity unrelated to Fingerlakes Wealth Management. © 2012,2014 Advicent Solutions. All rights reserved.

News and insights for your financial future.

Feel good about

your financial future.

Tailored guidance to help you make smart financial choices

Comprehensive planning and holistic wealth management

Advice that integrates with your values at every stage of life