Inheriting an IRA

If you get an inheritance from your spouse, parents or other generous benefactor, chances are that all or some of that inheritance will be in the form of an IRA.

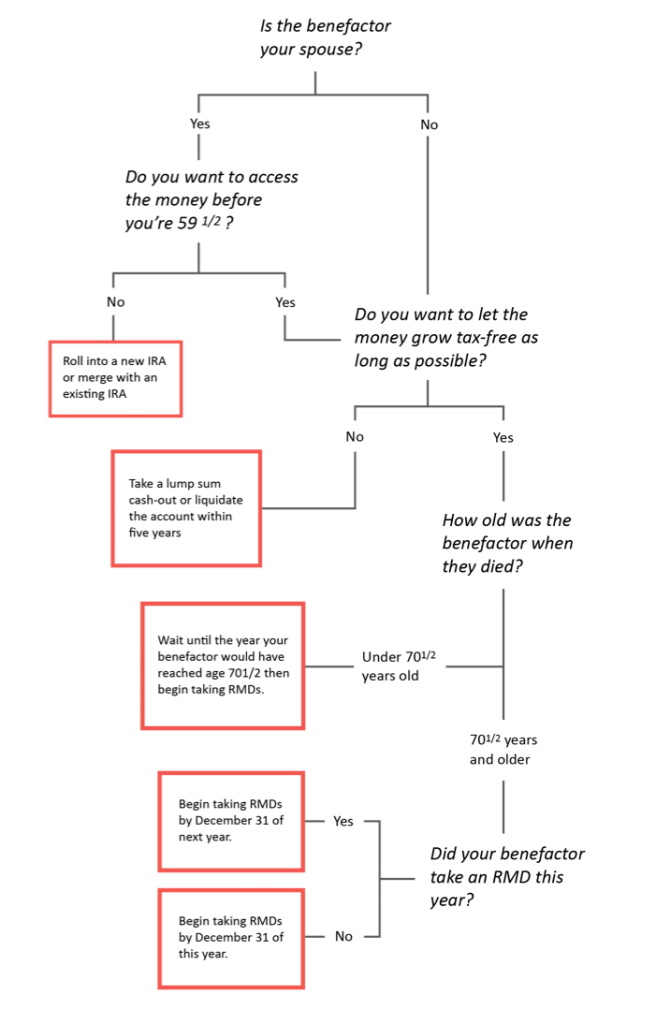

If you get an inheritance from your spouse, parents or other generous benefactor, chances are that all or some of that inheritance will be in the form of an IRA. Many people are opting for IRAs, especially retirees who often roll over their 401(k) upon retiring. The rules for accepting an inherited IRA are different than for inherited cash. Your options depend on what type of IRA (Roth or Traditional), who’s giving it to you (spouse or non-spouse) and how old the benefactor was. It’s easy for a simple misstep to lead to a large tax bill, so tread carefully when inheriting an IRA.

Not from a Spouse

You have two options when inheriting an IRA from someone other than your spouse: You can cash it out or you can take annual distributions. You cannot roll it into your own IRA, continue contributing to it or combine it with other inherited IRAs.

Life Expectancy Distributions

When you turn 70 ½ years old, you are required to make annual minimum distributions from your IRA; the same goes for an inherited IRA, except you don’t wait until you’re 70 ½. When you start taking these distributions depends on your benefactor’s age and whether he or she took a distribution in the year that they died. If the previous IRA holder was under 70 ½ years old, and thus hadn’t been taking required minimum distributions (RMDs), you can defer taking distributions until the point at which the benefactor would have begun.

If your benefactor was 70 ½ years old or older, he or she should have already begun taking distributions. In this case, you’ll continue to take them. You’ll need to know if he or she took the RMD in his or her final year or not. If yes, you have until the next year to start. Otherwise, you have until Dec. 31 in the year he or she died to take your first RMD.

The amount you’re required to take each year depends on your age and life expectancy. If you’re young when you inherit the IRA, your RMDs will start small and gradually increase as you age. The only exception is your first RMD, if taken the year your benefactor died. This RMD will be equal to the amount he or she would have taken. The good news is that your distributions will not be subject to the usual 10 percent early withdrawal fee, even though you may be younger than 70 ½ when taking them.

It’s easy for a simple misstep to lead to a large tax bill, so tread carefully when inheriting an IRA.

Cash Out

You can alternatively cash out the inherited IRA for the full amount upon receipt. This choice is usually not recommended because you’ll have to pay a hefty tax bill. Additionally, the opportunity for tax-free growth is the most valuable part of inheriting an IRA, and cashing out voids that benefit.

Another option is the “five-year rule,” which allows you to take distributions of any amount within the five-year period following your benefactor’s death. This cash out plan is only an option if your benefactor died before his or her RMDs began. The five-year rule is also likely not the best option from a tax standpoint, but it becomes the default if the beneficiary takes no action for life expectancy distributions.

From a Spouse

If you inherit an IRA from your spouse, you have three options for what to do with it. You can take the same actions as if it weren’t from a spouse by electing annual distributions or a cash-out, and you have the additional option of treating it as your own IRA. This means you can either roll it over into a new IRA or merge it with an existing account. In both cases, you’ll have the ability to contribute money that will grow tax-free, an option not available for IRAs inherited by non-spouses. The benefit of this is that you can let the money continue to grow without having to take any RMDs until you reach age 70 ½. The only drawback is that you’ll be unable to access any of the money within the IRA before the age of 59 ½ without paying an early withdrawal fee; if you elected to take RMDs instead, you’d have access to money every year without paying a fee.

Roth IRAs

If your benefactor had a Roth IRA, that means the money he or she contributed to it was taxed before it went in. For a Traditional IRA, the contributions are pre-tax, and they are instead taxed when withdrawn in retirement. For the most part, your IRA inheritance will be the same whether you’re receiving a Traditional or Roth IRA. The same rules apply and the same options are available to you as the beneficiary. The main difference is that distributions from an inherited Roth IRA will not be taxed (as long as the account is at least five years old), whereas distributions from a Traditional IRA will be. If you inherited a Roth IRA that is less than five years old, you have to wait until it is five years old before you begin taking tax-free withdrawals. It’s also important to note that the original owner of a Roth IRA never has to make RMDs, but if you inherit a Roth IRA, you do have to, just as you would with a Traditional IRA.

Common Pitfalls to Avoid

It can be surprisingly easy to make a mistake involving an inherited IRA, costing you thousands or even hundreds of thousands of dollars. Proceed with caution by avoiding these common pitfalls:

- You’re not allowed to merge an inherited IRA with your own if it didn’t belong to your spouse previously. Don’t try to get around this rule by cashing out your inheritance and reinvesting it in your own account; this will trigger a taxable event and turn the entire IRA into taxable income.

- If you’d like to move your inherited IRA to a different custodian, you’ll need to make a trustee-to-trustee transfer so that the money won’t be counted as income. If you withdrew from your own IRA, you could reinvest the money within 60 days without penalty; with an inherited IRA, the 60-day rule is not in effect.

- Similarly, if you opt to cash out an IRA immediately after inheriting it, your tax bill for that year will be much higher than usual, as the contents of the account will be considered income. By doing this, you’ll also be missing years of tax-free growth.

- If you don’t take your RMDs on time and/or fail to liquidate the account within five years of your benefactor’s death, you could be hit with a fine up to 50 percent of the account’s value. This is especially likely if your benefactor dies late in the year without having taken his or her RMD for the year.

- Make sure you specify that you’re electing the life expectancy distributions option so that you’re not forced into the five-year rule by default.

- If you inherit an entire estate that is large enough to qualify for estate taxes, you are responsible for paying them. However, if you only inherit the IRA, the estate taxes will be paid by the estate’s beneficiary. Even though you won’t have paid the estate taxes, you can still take the estate tax deduction when withdrawing from the inherited IRA.

- It’s important to talk with your Fingerlakes Wealth Management financial advisor immediately after inheriting an IRA to make sure you don’t make any costly mistakes.

The information contained in this article is not intended to be tax, investment, or legal advice, and it may not be relied on for the purpose of avoiding any tax penalties. Fingerlakes Wealth Management does not provide tax or legal advice. You are encouraged to consult with your tax advisor or attorney regarding specific tax issues. This article was written by Advicent Solutions, an entity unrelated to Fingerlakes Wealth Management. ©2013 Advicent Solutions. All rights reserved.

News and insights for your financial future.

Feel good about

your financial future.

Tailored guidance to help you make smart financial choices

Comprehensive planning and holistic wealth management

Advice that integrates with your values at every stage of life