Evaluating Charities

A charity may have the best of intentions yet still inefficiently spend its donations. Learn how to research a charity’s efficacy and see where your charitable dollars are really going.

A charity may have the best of intentions yet still inefficiently spend its donations. Learn how to research a charity’s efficacy and see where your charitable dollars are really going.

When we give to charity, we like to think that every dollar donated goes straight to the cause it supports. However, every charity has expenses that it must pay for out of its funding. While most charities will do their best to make sure their programs or grants receive the majority of your donation, it’s important to research any charity you are considering donating to so that you can evaluate how efficient they are and, more importantly, if they are truly supporting the causes they claim to.

According to Charity Navigator, seven out of 10 nonprofits surveyed spend at least 75 percent of expenses directly on their programs, rather than on administrative overhead or fundraising costs.

Check Legitimacy

The first step in researching a charity is to verify it is a legitimate charitable organization. All tax-exempt organizations with at least $5,000 in annual gross receipts must register with the IRS; however, religious congregations have automatic nonprofit status and don’t need to register or file a Form 990, an annual reporting return that provides information on the filing organization’s mission, programs and finances. Some religious congregations will still apply for tax-exempt status to assure contributors that they are recognized as exempt, but they are not required to do so.

If you would like to donate to a religious congregation, you will likely have to do firsthand research to determine its validity, as IRS records may not be available.

For all other types of organizations, you can simply search the charity’s name and employer identification number (EIN) on the IRS website, www.irs.gov, to find what you need. By using the “Exempt Organizations Select Check,” you can prove that a charity is registered as tax-exempt. You can request a copy of an organization’s Form 990 from the IRS, although you will be subject to a fee and a waiting period.

Other resources, such as the Foundation Center’s “990 Finder,” will allow you to access organizations’ forms online.

Look into Fiscal Responsibility

A charity’s Form 990 can provide you with a wealth of financial information for your evaluation process.

Keep in mind that while charitable organizations with $5,000 or more in annual gross receipts must register with the IRS, they are not required to actually file a full Form 990 until they reach annual gross receipts of $50,000, so all of this information may not be available for smaller charities.

Look for the following things when perusing an organization’s Form 990:

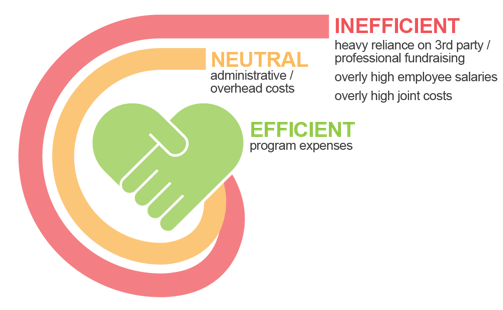

Program Expenses

By looking at the total amount of money that a charity spends on program services compared to its total expenses, you can figure out how much of its money is actually going to programs and how much is going to other costs.

According to Charity Navigator, seven out of 10 nonprofits surveyed spend at least 75 percent of expenses directly on their programs, rather than on administrative overhead or fundraising costs. However, it’s not always effective to compare this efficiency ratio for charities that are in vastly different industries or to compare a well-established charity with a fledgling one. New charities especially will likely have to use more of your donation for start-up costs, but if it’s a cause you believe in, it should be worth it to get the charity running.

Executive Salaries

A Form 990 should also show the salaries of the top earners at the charity. When comparing reasonable salaries, keep in mind the geographic location, size of the organization and the type of work these employees performed.

Professional Fundraising Services

Some charities use professional fundraising firms to garner donations, which means that a significant percentage of your donation might be going to pay these professionals rather than to the charity itself.

Joint Costs

Joint costs are activities that combine educational campaigns with fundraising, such as a direct mail campaign that solicits money while advising people not to drink and drive. This can help charities disguise their fundraising costs while inflating their program services, so be aware if joint costs are an unusually high percentage of the total program expenses.

Types of Support

Does the charity rely solely on donations, or do they also have government support or a supporting organization? Multiple sources of support can be beneficial, since it means that the charity will be able to stay afloat if one source of revenue drops.

At the end of the day, you can only rely on financial ratios for so long. Although they can be useful tools, they should not be the end-all be-all for your donation decisions. You should also rely on your own research as well as the results that the charity has achieved with its donations.

Research the Charity’s Goals and Strategies

Looking into a charity or foundation’s operations can help you determine whether it deserves your attention. Any number of records can help reveal the effect an organization has on the world. Here are some specific things to look at:

Mission statement

You should always know what a charity stands for before donating. Having a charity with a purpose you believe in is essential to making a fulfilling donation.

Affiliated charities

Most charities are networked with other similar charities. Many charities are support organizations that distribute donations to more specific charitable programs or nonprofits. If larger, well-known charities support your target charity, it is likely doing an outstanding job.

Age and size

How big is the charity and how long has it been around? Ineffective charities often do not last long and fail to attract attention. The best charities tend to be the ones that grow.

Online information

Check the charity’s website and reading material to see what it says about itself. There are several websites devoted to ranking charities by impact and success. Read as much as you can about what others have to say about your target charity.

Check the long-term plans

See what the charity’s goals are for the future. Do they seem realistic? Try and find out what the results of their previous campaigns were. Successful charities meet their goals for a reason (good management, planning, etc.) and are likely to reach their goals in the future.

No secrets

Charities that make an effort to promote transparency within the organization have nothing to hide. They are proud of their efficiency, management and reaching goals on budget.

Success and efficiency are important for evaluating a charity, but they do not count for everything. Keep in mind that although less established charities might seem less impressive than others, they could be trying to fill a need that larger charities have overlooked.

Consider the Type of Gift

It sometimes seems like there are as many ways to give as there are charities to help. It is important to pick a charity that will work with your intended method of donation. For example, charitable gift annuities (CGAs) can have huge benefits for both donor and recipient, but require the charity to run its own annuity program. Similarly, smaller charities cannot always handle complex gifts (property, appreciated assets, etc.) and should be contacted with questions about acceptable donations.

Measure Results

To achieve success, a charity should have some way to measure its progress. You should ask yourself if the charity’s mission clearly addresses a problem and a plan to solve it. Does this solution seem reasonable to you? Does the charity have any evidence that the solution is working? Does the charity collect feedback from the people or causes it aims to help? Does it have a plan in place to collect data that proves its success, and is this data meaningful? Has the charity been evaluated by a third-party source?

You can also look at the “statement of program service accomplishments” on the charity’s Form 990, which shows its largest programs as well as the funds allocated to them. Does this allocation seem fair to you, and is it line with what the charity’s mission promises?

Although there may not be a hard and fast way to measure a charity’s social impact, it should have a plan in place to determine if it is reaching its goals and, if not, how it can change so that it does meet its goals.

Beyond Research

Research is an important part of the evaluation process, but it’s equally important to talk to members of the charity you are considering and to visit the charity, if possible.

If you’re unable to visit the charity, you may be able to use a site such as Charity Navigator, Charity Watch or GuideStar to look up an organization’s information.

Before donating, you should have a feel for how the employees treat donors and constituents and you should feel free to ask the charity for an overview of the organization, mission and programs at the very least.

Remember that it’s your donation, and just as you want to be confident in a company before investing in its stock, you should also be confident in a charity before donating your funds.

By thoroughly evaluating charities before making a donation, you can help ensure that your money will be used in the most efficient way possible, aiding your overall charitable strategy.

This article was written by Advicent Solutions, an entity unrelated to Fingerlakes Wealth Management. The information contained in this article is not intended to be tax, investment, or legal advice, and it may not be relied on for the purpose of avoiding any tax penalties. Fingerlakes Wealth Management does not provide tax or legal advice. You are encouraged to consult with your tax advisor or attorney regarding specific tax issues. © 2013 Advicent Solutions. All rights reserved.

News and insights for your financial future.

Feel good about

your financial future.

Tailored guidance to help you make smart financial choices

Comprehensive planning and holistic wealth management

Advice that integrates with your values at every stage of life